| (7) | Joined the Annual Meeting. We expect all current directors will attend the Annual Meeting.Committees of the Board

Overview

Our Board has the following six standing committees (each, a “Committee” and collectively, the “Committees”):

the Audit Committee,

the Compensation Committee,

the Executive Committee,

the Finance and Strategy Committee,

the Nominating and Governance Committee; and

the Risk Committee.

Other than the members of the Executive Committee required to be on such Committee pursuant to our Bylaws, each of the members of the Committees was recommended by the Nominating and Governance Committee for approval by the Board for service on that Committee. Each of the

| Cboe Global Markets 2019 Proxy Statement

| 15

August 14, 2020. |

Committees has a charter, which is available on the Corporate Governance page of our Investor Relations section of our website at: http://ir.Cboe.com.

The following table is a listing of the composition of our standing Committees during 2018 and as of March 19, 2019, including the number of meetings of each Committee during 2018.

| | | | | | | | Finance and | | Nominating and | | | Director | | Audit | | Compensation | | Executive | | Strategy | | Governance | | Risk | Number of meetings | | 8 | | 6 | | — | | 5 | | 5 | | 5 | Edward T. Tilly(1) | | | | | | | |

| | | | | | | | | | | Eugene S. Sunshine(1) | | | | |

| (2) | |

| | | | | |

| (2,3) | | | | James R. Boris(4) | | | | | | | |

| (2) | | | | | | | | | | Frank E. English, Jr. | | | | |

| | | | | |

| | |

| (5) | | | | William M. Farrow, III | |

| | | | | |

| (5) | | | | | | | |

| (6) | Edward J. Fitzpatrick | |

| (2,7) | |

| (8) | |

| | |

| (2) | | | | |

| (5) | Janet P. Froetscher | | | | |

| | | | | | | | |

| (5) | |

| | Jill R. Goodman | | | | | | | |

| (5) | |

| (9) | |

| | | | | Christopher T. Mitchell(4) | | | | | | | | | | |

| (2) | | | | | | | Roderick A. Palmore | | | | | | | |

| | |

| (5) | |

| (3) | |

| (2,6) | James E. Parisi | |

| (5) | |

| (5) | | | | | | | | | | | | | Joseph P. Ratterman | | | | | | | | | | |

| | | | | | | | Michael L. Richter | |

| | | | | | | | | | | | | | |

| | Samuel K. Skinner(4) | | | | |

| (2,8) | |

| (2) | | | | |

| (2) | | | | Jill E. Sommers | | | | | | | | | | |

| (5) | | | | | | | Carole E. Stone | |

| (7) | | | | |

| | |

| (2,9) | |

| | |

| (5) |

= Chair  = Member

| (1)

| | The Chairman and Lead Director are both members of the Executive Committee and invited guests to the meetings of each of the other standing Committees.

|

| (2)

| | Stepped down as a member of the Committee on May 17, 2018.

|

| (3)

| | Effective May 17, 2018, Mr. Palmore became Chair of the Nominating and Governance Committee and Mr. Sunshine stepped down as Chair and a member of the Nominating and Governance Committee.

|

| (4)

| | Messrs. Boris, Mitchell and Skinner stepped down as members of the Board and Committees in connection with the 2018 Annual Meeting of Stockholders on May 17, 2018.

|

| (5)

| | Joined the Committee on May 17, 2018.

|

| (6)

| | Effective May 17, 2018, Mr. Farrow became Chair of the Risk Committee and Mr. Palmore stepped down as Chair and a member of the Risk Committee.

|

| (7)

| | Effective May 17, 2018, Ms. Stone became Chair of the Audit Committee and Mr. Fitzpatrick stepped down as Chair and a member of the Audit Committee.

|

| (8)

| | Effective May 17, 2018, Mr. Fitzpatrick became Chair of the Compensation Committee and Mr. Skinner stepped down as Chair and a member of the Compensation Committee.

|

| (9)

| | Effective May 17, 2018, Ms. Goodman became Chair of the Finance and Strategy Committee and Ms. Stone stepped down as Chair and a member of the Finance and Strategy Committee.

|

16

| Cboe Global Markets 2019 Proxy Statement

| |

Audit Committee

The Audit Committee consists of 4 directors, all of whom are independent under BZX and Nasdaq listing rules, as well as under Rule 10A‑3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Audit Committee consists exclusively of directors who are financially literate. In addition,

| (8) | Effective May 12, 2020, Mr. Parisi has been designated as our audit committee financial expert and meets the SEC definition of that position.The Audit Committee’s responsibilities include:

engaging our independent auditor and overseeing its compensation, work and performance,

reviewing and discussing the annual and quarterly financial statements and related press releases with management and the independent auditor, and

reviewing transactions with related persons for potential conflict of interest situations.

The Audit Committee also meets with our independent auditor in executive session without management present and our independent auditor may communicate directly, as needed, with membersbecame Chair of the Audit Committee and the Board at large.

Compensation Committee

The Compensation Committee consists of 4 directors, all of whom are independent under BZXMs. Stone stepped down as Chair and Nasdaq listing rules. The Compensation Committee has primary responsibility to approve or make recommendations to the Board for:

all elements and amounts of compensation for the executive officers, including any performance goals,

reviewing succession plans relating to the CEO and our other executive officers,

the adoption, amendment and termination of cash and equity-based incentive compensation plans,

approving any employment agreements, severance agreements or change in control agreements with executive officers, and

the level and form of non-employee director compensation and benefits.

Nominating and Governance Committee

Overview

The Nominating and Governance Committee consists of 5 directors, all of whom are independent under BZX and Nasdaq listing rules. The Nominating and Governance Committee’s responsibilities include making recommendations to the Board on:

persons for election as director,

director to serve as Chairmanmember of the Board and anAudit Committee.

|

Audit Committee The Audit Committee consists of 5 directors, all of whom are independent under BZX listing rules, as well as under Rule 10A-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Audit Committee consists exclusively of directors who are financially literate. In addition, Mr. Parisi has been designated as our audit committee financial expert and meets the SEC definition of that position. The Audit Committee’s responsibilities include:  engaging our independent auditor and overseeing its compensation, work, and performance, engaging our independent auditor and overseeing its compensation, work, and performance,

reviewing and discussing the annual and quarterly financial statements and related press releases with management and the independent auditor, and reviewing and discussing the annual and quarterly financial statements and related press releases with management and the independent auditor, and

reviewing transactions with related persons for potential conflict of interest situations. reviewing transactions with related persons for potential conflict of interest situations.

The Audit Committee also meets with our independent auditor in executive session without management present and our independent auditor may communicate directly, as needed, with members of the Audit Committee and the Board at large. Compensation Committee The Compensation Committee consists of 4 directors, all of whom are independent under BZX listing rules. The Compensation Committee has primary responsibility to approve or make recommendations to the Board for:  all elements and amounts of compensation for the executive officers, including any performance goals, all elements and amounts of compensation for the executive officers, including any performance goals,

reviewing succession plans relating to the CEO and our other executive officers, reviewing succession plans relating to the CEO and our other executive officers,

the adoption, amendment and termination of cash and equity-based incentive compensation plans, the adoption, amendment and termination of cash and equity-based incentive compensation plans,

approving any employment agreements, severance agreements, or change in control agreements with executive officers, approving any employment agreements, severance agreements, or change in control agreements with executive officers,

oversee the policies and strategies relating to talent, leadership, and culture, including diversity and inclusion, and oversee the policies and strategies relating to talent, leadership, and culture, including diversity and inclusion, and

the level and form of non-employee director compensation and benefits. the level and form of non-employee director compensation and benefits.

Nominating and Governance Committee Overview The Nominating and Governance Committee consists of 5 directors, all of whom are independent under BZX listing rules. The Nominating and Governance Committee’s responsibilities include making recommendations to the Board on:  persons for election as director, persons for election as director, to serve as Lead Director,

any stockholder proposals and nominations for director,

the appropriate structure, operations and composition of the Board and its Committees,

the Board and Committee annual self-evaluation process, and

the contents of the Corporate Governance Guidelines, Code of Business Conduct and Ethics and other corporate governance policies and programs.

| Cboe Global Markets 2019 Proxy Statement

| 17

|

| Cboe Global Markets 2021 Proxy Statement | 23 |

a director to serve as Chairman of the Board and an independent director to serve as Lead Director, a director to serve as Chairman of the Board and an independent director to serve as Lead Director,

any stockholder proposals and nominations for director, any stockholder proposals and nominations for director,

the appropriate structure, operations and composition of the Board and its Committees, the appropriate structure, operations and composition of the Board and its Committees,

the Board and Committee annual self-evaluation process, and the Board and Committee annual self-evaluation process, and

the contents of the Corporate Governance Guidelines, Code of Business Conduct and Ethics, and other corporate governance policies and programs. the contents of the Corporate Governance Guidelines, Code of Business Conduct and Ethics, and other corporate governance policies and programs.

The Nominating and Governance Committee is also responsible for overseeing environmental, social, and governance (“ESG”). For additional information, see “Corporate Governance—Corporate Social Responsibility”. Criteria for Directors We believe that each of the individuals serving on our Board has the necessary skills, qualifications and experiences to address the challenges and opportunities we face. The Nominating and Governance Committee is responsible for considering and recommending to the Board nominees for election as director, including considering each incumbent director’s continued service on the Board. The Committee annually reviews the skills and characteristics required of all directors in the context of the current composition of the Board, our operating requirements, targeted skills and experiences, and the long-term interests of our stockholders. In evaluating incumbent and new potential director candidates, the Committee takes into consideration many factors, including the individual’s educational and professional background, whether the individual has any special experience in a relevant area, personal accomplishments, and cultural experiences. In addition, the Committee may consider such other factors it deems appropriate when conducting its assessment of director candidates. 18

| Cboe Global Markets 2019 Proxy Statement

| |

Annual Board and Committee Self-Evaluations

The Board believes that a robust annual evaluation process is a critical part of its governance practices. The Nominating and Governance Committee is responsible for establishing and overseeing the Board’s and Committees’ annual self-evaluations to determine whether the Board and the Committees are functioning effectively and to identify potential areas of improvement. The annual self-evaluation process includes the following:

Stage in Process

| Board of Directors

| Committees

| Determine Discussion Topics

|  Nominating and Governance Committee determines specific topics and subject areas to discuss with each director, such as roles, responsibilities, structure, skills, experience, background, composition and effectiveness

|  Nominating and Governance Committee determines and distributes to each Committee a list of specific topics and subject areas to facilitate discussion about each Committee’s roles and responsibilities, structure, charter, policies, composition and effectiveness

| Discussions

|  Chair of Nominating and Governance Committee and Lead Director interview each director in one-on-ones to discuss Board’s performance

|  Chair of each Committee facilitates discussion of Committee’s performance in executive session and in one-on-ones

| Feedback

|  Chair of Nominating and Governance Committee and Lead Director report results of discussions and recommendations to Nominating and Governance Committee for its consideration

|  Chair of each Committee reports results of Committee self-evaluation and recommendations to Nominating and Governance Committee for its consideration

| Reviews

|  Nominating and Governance Committee reviews results from Board and Committee self-evaluations and provides summary of assessments and recommendations to full Board

Board discusses results and, if necessary, provides additional recommendations

| Feedback Incorporated

|  Changes and enhancements, if any, are implemented to governance policies and practices

|

In addition to the annual evaluation process, the Board and Committees meet in regular executive sessions, which provides the directors with opportunities to reflect and provide feedback on an ongoing basis to determine whether the Board and the Committees are functioning effectively and to identify potential areas of improvement.

| Cboe Global Markets 2019 Proxy Statement

| 19

|

Diversity While we do not currently have a formal diversity policy, our Corporate Governance Guidelines provide that the Nominating and Governance Committee will seek to recommend to the Board candidates for director with a diverse range of experiences, qualifications, and skills in order to provide varied insights and competent guidance regarding our operations, with a goal of having a Board that reflects diverse backgrounds, experience, and viewpoints. We believe that we benefit from having directors with a diversity of skills, characteristics, backgrounds, and cultural experiences. Identifying and Evaluating New Directors The Nominating and Governance Committee utilizes a variety of methods to identify, recruit, and evaluate potential new director candidates. The Committee considers various potential candidates for director, considering the criteria discussed above and qualifications of the individual candidate. Board nominees can be identified by current directors, management, third-party professional search firms, stockholders, or other persons. Prior to a potential new director’s nomination, the director candidate is planned to meet separately with the Chairman of the Board, the Chair of the Nominating and Governance Committee, and the independent Lead Director, who will each consider the potential director’s candidacy. New director candidates may also meet separately with other members of the Board. In addition, a background check is completed before a final recommendation is made to the Board. After a review and evaluation of a potential new director based on the criteria discussed above, the Nominating and Governance Committee will decide whether to recommend to the Board the candidate’s appointment as a director or nominee for election as a director, and the Board will decide whether to approve the candidate’s appointment as a director or a nominee. 24 | Cboe Global Markets 2021 Proxy Statement | |

Onboarding New Directors New directors participate in a robust all-day orientation program to familiarize themselves with the company and management. Our orientation program for new directors includes a discussion of a broad range of topics, including the background of the company, the Board and its governance model, subsidiary governance, regulatory oversight, strategy and business operations, financial statements and capital structure, the management team, key industry and competitive factors, the legal and ethical responsibilities of the Board, and other matters crucial to the ability of a new director to fulfill his or her responsibilities. Retirement Our Corporate Governance Guidelines provide that once an individual serving on our Board reaches age 71, the Board shall begin to discuss the retirement plan with respect to such director. The Board expects that no director shall be elected or reelected as a director once he or she reaches age 73. Any director who turns 73 while serving as a director may continue to serve for the remainder of their current term. | Cboe Global Markets 2021 Proxy Statement | 25 |

Annual Board and Committee Self-Evaluations The Board believes that a robust annual evaluation process is a critical part of its governance practices. The Nominating and Governance Committee is responsible for establishing and overseeing the Board’s and Committees’ annual self-evaluations to determine whether the Board and the Committees are functioning effectively and to identify potential areas of improvement. The annual self-evaluation process includes the following: Stage in Process | Board of Directors | Committees | Determine Discussion Topics ↓ |  Nominating and Governance Committee determines specific topics and subject areas to discuss with each director, such as roles, responsibilities, structure, skills, experience, background, composition, and effectiveness Nominating and Governance Committee determines specific topics and subject areas to discuss with each director, such as roles, responsibilities, structure, skills, experience, background, composition, and effectiveness

|  Nominating and Governance Committee determines and distributes to each Committee a list of specific topics and subject areas to facilitate discussion about each Committee’s roles and responsibilities, structure, charter, policies, composition, and effectiveness Nominating and Governance Committee determines and distributes to each Committee a list of specific topics and subject areas to facilitate discussion about each Committee’s roles and responsibilities, structure, charter, policies, composition, and effectiveness

| Discussions ↓ |  Chair of Nominating and Governance Committee and Lead Director interview each director in one-on-ones to discuss Board’s performance Chair of Nominating and Governance Committee and Lead Director interview each director in one-on-ones to discuss Board’s performance

|  Chair of each Committee facilitates discussion of Committee’s performance in executive session and in one-on-ones Chair of each Committee facilitates discussion of Committee’s performance in executive session and in one-on-ones

| Feedback ↓ |  Chair of Nominating and Governance Committee and Lead Director report results of discussions and recommendations to Nominating and Governance Committee for its consideration Chair of Nominating and Governance Committee and Lead Director report results of discussions and recommendations to Nominating and Governance Committee for its consideration

|  Chair of each Committee reports results of Committee self-evaluation and recommendations to Nominating and Governance Committee for its consideration Chair of each Committee reports results of Committee self-evaluation and recommendations to Nominating and Governance Committee for its consideration

| Reviews ↓ |  Nominating and Governance Committee reviews results from Board and Committee self-evaluations and provides summary of assessments and recommendations to full Board Nominating and Governance Committee reviews results from Board and Committee self-evaluations and provides summary of assessments and recommendations to full Board

Board discusses results and, if necessary, provides additional recommendations Board discusses results and, if necessary, provides additional recommendations

| Feedback Incorporated |  Changes and enhancements, if any, are implemented to governance policies and practices Changes and enhancements, if any, are implemented to governance policies and practices

|

In addition to the annual evaluation process, the Board and Committees meet in regular executive sessions, which provides the directors with opportunities to reflect and provide feedback on an ongoing basis to determine whether the Board and the Committees are functioning effectively and to identify potential areas of improvement. 26 | Cboe Global Markets 2021 Proxy Statement | |

Stockholder Nominations The Nominating and Governance Committee will consider stockholder recommendations for candidates for our Board and will consider those candidates using the same criteria applied to candidates suggested by management. Stockholders may recommend candidates for our Board by contacting the Corporate Secretary of Cboe Global Markets, Inc. at 400 South LaSalle Street, Chicago, Illinois 60605. In addition, stockholders may formally nominate candidates for our Board to be considered at an annual meeting of stockholders through the process described below under the heading “Stockholder Proposals.”“Other Items—Stockholder Proposals”. ATS Oversight Committee The ATS Oversight Committee, formed on November 20, 2020, is responsible for, among other things, overseeing the business and operations of BIDS Trading’s U.S. equities businesses, overseeing the adequacy and effectiveness of the information and other barriers established to maintain the separation of BIDS Trading’s U.S. equities businesses from Cboe Global Markets’ registered national exchange businesses, and helping to ensure that specified functions of those BIDS Trading’s U.S. equities businesses are independent of and not integrated with or otherwise linked to Cboe Global Markets’ registered national exchange businesses. Executive Committee The Executive Committee has the authority to exercise the powers and authority of the Board when the convening of the Board is not practicable, except as limited by its charter, the Company’s Bylaws and applicable law. Finance and Strategy Committee The Finance and Strategy Committee’s responsibilities include approving or making recommendations to the Board regarding the budget, capital allocation, strategic plans, and acquisition or investment opportunities. Risk Committee The Risk Committee is generally responsible for, among other things, overseeing the risk assessment and risk management of the Company, including risk related to cybersecurity, information technology, and the Company’s compliance with laws, regulations, and its policies. Compensation Committee Interlocks and Insider Participation No member of the Compensation Committee is a current or former officer or employee of ours. In addition, there are no compensation committee interlocks with other entities with respect to any member of the Compensation Committee. | Cboe Global Markets 2021 Proxy Statement | 27 |

Stockholder Engagement Cboe Global Markets and its Board are committed to fostering long-term and institution-wide relationships with stockholders and maintaining their trust and goodwill. As a result, each year we interact with stockholders through a variety of engagement activities. These engagements routinely cover strategy and performance, corporate governance, executive compensation, and other current and emerging issues to help ensure that our Board and management understand and address the issues that are important to our stockholders. Our key stockholder engagement activities in 20182020 included attending virtual investor and industry conferences, participating in informational fireside chats, conducting telephonic investor road shows, in major U.S. cities and hosting meetings at our 20

| Cboe Global Markets 2019 Proxy Statement

| |

corporate headquarters.telephonic meetings. Some of these conferences also featured webcasts and replays of the presentations so that our stockholders could listen remotely. In 2018,2020, we engaged with holders of approximately 4035 percent of our common stock outstanding.

In 20182020 and early 2019,2021, we also conducted an outreach specifically focused on corporate governance, executive compensation, and proxy season trends and issues, targeting our top ten stockholders that represent nearlyrepresented approximately 45 percent of institutional holdings.our common stock outstanding and engaged with holders of approximately 20 percent of our common stock outstanding. Through these discussions we gained valuable feedback, and this feedback was shared with the Board and its relevant Committees. We also took steps to address any areas of improvement, including by incorporating some of the disclosure suggestions into this Proxy Statement. In addition, our quarterly earnings calls are open to the general public and feature a live webcast. The Annual Meeting, to be held in Chicago, also includes a live webcast, so all of our stockholders may listen to the meeting remotely if they are unable to attend the meeting in person. Communications with Directors As provided in our Corporate Governance Guidelines, stockholders and other interested parties may communicate directly with our independent directors or the entire Board. Our policy and procedures regarding these communications are located in the Investor Relations section of our website at http://ir.Cboe.com. CORPORATE SOCIAL RESPONSIBILITY The Board of Directors recognizes that operating in a socially responsible manner helps promote the long-term interests of our stockholders, organization, associates, industry, and community. Our guiding principles help us deliver on our corporate mission and strategy, including good citizenship.

BeingWe believe that being a good citizen means that we hold ourselves accountable for the integrity of the markets and to the communities we serve, seek to help resolve conflicts and build consensus, inform those impacted before taking action, lead by example, and serve as part of the solution. More specifically, beingWe also seek to be good citizens to the communities we serve means that we areby being committed to being environmentally conscious. Additionally, being good citizens also means that we strive to support our associates and better serve our industry and community through our human capital development, volunteerism and policies.

28 | Cboe Global Markets 20192021 Proxy Statement | 21

|

Additional information on our approach to ESG can be found in the Cboe Global Markets, Inc. ESG Report located in the Corporate Social Responsibility section of our website at https://markets.cboe.com/about/corporate-social-responsibility, which does not form a part of this Proxy Statement. Further, our 2020 Annual Report to Stockholders included in this mailing, which includes a copy of our Annual Report on Form 10-K for the year ended December 31, 2020, also contains relevant additional information under “Part I—Item 1. Business—Human Capital Management”. See also herein “Corporate Governance—Board Structure—Board Oversight of Human Capital”. | Cboe Global Markets 2021 Proxy Statement | 29 |

director compensation Compensation Philosophy and Summary The cash and stock retainers, committee meeting attendance fees, committee chair retainers and additional Lead Director fee paid to our non-employee directors are designed to be part of a competitive totalOur director compensation package when compared to market practices. Theprogram provides director fees that are generally designed to be paid at competitive levels that are near the median of director fees of our peer groups,group, which areis discussed in further detail below in the “Executive Compensation — Compensation—Compensation Discussion and Analysis” section. Typically, early in each year,This allows us to attract and retain individuals with the skills, qualifications, and experiences required to sit on our Board.

Annually, the Compensation Committee considersreviews a review of competitive market data analysis for Boardnon-employee director compensation fromproduced by Meridian Compensation Partners, LLC (“Meridian”), our independent compensation consultant, and recommends changes to our director compensation program, if any, to the Board for approval. For 2020, our director compensation program consisted of a mix of: cash and stock retainers, committee meeting attendance fees, committee chair retainers, and an additional Lead Director retainer. 2020 Elements of Director Compensation Program The compensation of our non-employee directors is based upon a compensation year beginning and ending in May at the time of our Annual Meeting of Stockholders. 2018 Elements of Director Compensation Program

The following table reflects the amount paid with respect to each component of our director compensation including any enhancements,program for the Board term ending with the 20182020 Annual Meeting of Stockholders and for the Board term ending with the Annual Meeting in 2019: 2021: Annual Fees | May 2017 —

May 2018 | | May 2018 —

May 2019 | May 2019 —

May 2020 | | May 2020 —

May 2021 | Cash retainer | $ | 90,000 | | $ | 90,000 | $ | 90,000 | | $ | 90,000 | Stock retainer, value based on closing price on date of grant | $ | 100,000 | | $ | 120,000 | $ | 130,000 | | $ | 145,000 | Committee chair cash retainer | | | | | | | | | | | ATS Oversight | | $ | — | | $ | 20,000 | Audit | $ | 25,000 | | $ | 25,000 | $ | 25,000 | | $ | 25,000 | Compensation | $ | 15,000 | | $ | 15,000 | $ | 15,000 | | $ | 15,000 | Finance and Strategy | $ | 15,000 | | $ | 15,000 | $ | 15,000 | | $ | 15,000 | Nominating and Governance | $ | 15,000 | | $ | 15,000 | $ | 15,000 | | $ | 15,000 | Risk | $ | 20,000 | | $ | 20,000 | $ | 20,000 | | $ | 20,000 | Lead Director cash retainer, in addition to above cash and stock retainers | $ | 150,000 | | $ | 50,000 | $ | 50,000 | | $ | 50,000 | Meeting Fees | | | | | | | | | | | Committee meeting attendance fee per meeting attended | $ | 1,500 | | $ | 1,500 | $ | 1,500 | | $ | 1,500 | Lead Director meeting attendance fee per Committee meeting attended for the Company and for each subsidiary board of directors or committee meeting attended | $ | — | | $ | 1,500 | $ | 1,500 | | $ | 1,500 |

30 | Cboe Global Markets 2021 Proxy Statement | |

In early 2018,2020, the Board increased the stock retainer to more closely align with the Broader Financial and Technology Industryour peer group compensation median. The Board also adjusted the stock retainer, and not the cash retainer, to better align with our peer groups’group’s pay mix and to continue tofurther align our directors’ interests with our stockholders. In addition, following the creation of the RiskThe ATS Oversight Committee in late 2017, the Board approved the Risk Committee chair received a pro rata cash retainer in early 2018. 2020. 22

| Cboe Global Markets 2019 Proxy Statement

| |

20182020 Director Compensation

The compensation of our non-employee directors for the year ended December 31, 20182020 for their service is shown in the following table. | | Fees Earned or | | Stock | | | | | | | Fees Earned or | | Stock | | All other | | | | Name | | Paid in Cash | | Awards(1) | Total | | Paid in Cash | | Awards(1) | | Compensation(2) | | Total | Eugene S. Sunshine (2)(3) | | $ | 180,000 | | $ | 120,085 | $ | 300,085 | | $ | 255,500 | | $ | 145,088 | | $ | 11,900 | | $ | 412,488 | James R. Boris (3) | | $ | 120,000 | | $ | — | $ | 120,000 | | Frank E. English, Jr. (4) | | | $ | 55,500 | | $ | — | | $ | — | | $ | 55,000 | William M. Farrow, III | | | $ | 132,500 | | $ | 145,088 | | $ | — | | $ | 277,588 | Edward J. Fitzpatrick | | $ | 131,000 | | $ | 120,085 | $ | 251,085 | | $ | 123,000 | | $ | 145,088 | | $ | — | | $ | 268,088 | Frank E. English, Jr. | | $ | 111,000 | | $ | 120,085 | $ | 231,085 | | William M. Farrow, III | | $ | 115,000 | | $ | 120,085 | $ | 235,085 | | Ivan K. Fong (5) | | | $ | 13,500 | | $ | 58,022 | | $ | — | | $ | 71,522 | Janet P. Froetscher | | $ | 106,500 | | $ | 120,085 | $ | 226,585 | | $ | 121,500 | | $ | 145,088 | | $ | 5,500 | | $ | 272,088 | Jill R. Goodman | | $ | 114,000 | | $ | 120,085 | $ | 234,085 | | $ | 127,500 | | $ | 145,088 | | $ | — | | $ | 272,588 | Christopher T. Mitchell(3) | | $ | 46,500 | | $ | — | $ | 46,500 | | Alexander J. Matturri, Jr. (5) | | | $ | 13,500 | | $ | 58,022 | | $ | — | | $ | 71,522 | Jennifer J. McPeek (5) | | | $ | 50,569 | | $ | 108,119 | | $ | — | | $ | 158,688 | Roderick A. Palmore | | $ | 121,000 | | $ | 120,085 | $ | 241,085 | | $ | 127,500 | | $ | 145,088 | | $ | — | | $ | 272,588 | James E. Parisi (4) | | $ | 98,875 | | $ | 120,085 | $ | 218,960 | | James E. Parisi (6) | | | $ | 197,250 | | $ | 145,088 | | $ | 10,000 | | $ | 352,338 | Joseph P. Ratterman | | $ | 97,500 | | $ | 120,085 | $ | 217,585 | | $ | 102,000 | | $ | 145,088 | | $ | — | | $ | 251,568 | Michael L. Richter | | $ | 105,000 | | $ | 120,085 | $ | 225,085 | | $ | 112,500 | | $ | 145,088 | | $ | 10,330 | | $ | 267,918 | Samuel K. Skinner (3) | | $ | 55,500 | | $ | — | $ | 55,500 | | Jill E. Sommers (5)(7) | | $ | 93,625 | | $ | 120,085 | $ | 213,710 | | $ | 261,000 | | $ | 145,088 | | $ | — | | $ | 406,088 | Carole E. Stone | | $ | 134,000 | | $ | 120,085 | $ | 254,085 | | $ | 74,000 | | $ | — | | $ | — | | $ | 74,000 | Fredric J. Tomczyk | | | $ | 105,000 | | $ | 145,088 | | $ | — | | $ | 250,088 |

| (1) | (1)

| | The non-employee directors then-serving on the Board received an equity grant of restricted stock on May 12, 2020, other than Ms. McPeek who received an equity grant of restricted stock on August 14, 2020 and Messrs. Fong and Matturri who each received an equity grant of restricted stock on December 17, 2018.2020. The equity grant vestsgrants vest on the earlier of the one year anniversary of the grant date or the completion of thetheir final year of director service. Each of thesethe listed directors who received an equity grant holds 1,1081,482 shares, other than Ms. McPeek who holds 1,225 shares and Messrs. Fong and Matturri who each holds 648 shares, of unvested restricted stock as of December 31, 2018. 2020. |

| (2) | (2)

Amounts shown in the All Other Compensation column represent matching gifts made to qualified non-profit organizations on behalf of non-employee directors and do not represent total charitable contributions made by them during the year. Amounts represent those provided through our Matching Gift Program that is available to full-time employees with typically at least one year of service and non-employee directors. During 2020, we matched eligible gifts from a minimum of $50 to an aggregate maximum gift of $10,000 per employee or non-employee director, per calendar year. In addition, in 2020, we matched at a rate of 1.5x eligible gifts from a minimum of $50 to $1,000 per employee or non-employee director, per calendar year to organizations that (i) support social justice and/or improve the lives of those in Black communities or (ii) provide services to COVID-19 global pandemic relief efforts. |

| (3) | | The amount shown in the Fees Earned or Paid in Cash column for Mr. Sunshine also includes fees of $6,000$28,500 for attending subsidiary Boardboard of Directorsdirectors or Committee meetings. |

| Cboe Global Markets 2021 Proxy Statement | 31 |

| (4) | (3)

| | Messrs. Boris, MitchellMr. English and SkinnerMs. Stone left the Board and Committees in connection with the 20182020 Annual Meeting of Stockholders on May 17, 2018.12, 2020. The amounts shown in the Fees Earned or Paid in Cash columnscolumn reflect the remaining cash retainers and Committee meeting fees while on the Board.

|

| (5) | (4)

Ms. McPeek and Messrs. Fong and Matturri who joined the Board on August 14, 2020 and December 17, 2020, respectively, also received the same compensation and equity as described above for all other directors, but on a pro-rata basis for the portion of time served in 2020. |

| (6) | | The amount shown in the Fees Earned or Paid in Cash column for Mr. Parisi also includes fees of $41,875$60,000 for his service as a member of the Boardsboards of Directorsdirectors of CFE and SEF. |

| (7) | (5)

| | The amount shown in the Fees Earned or Paid in Cash column for Ms. Sommers also includes fees of $42,625$160,500 for her service as a member of the Boardsboards of Directorsdirectors of our securities exchanges, CFE, and SEF. |

Director Stock Ownership and Holding Guidelines The Compensation Committee has adopted stock ownership and holding guidelines, which provide that each non-employee director should own stock equal to threefive times the cash annual retainer for directors within three five years of joining the Board.Board or within four years of May 2019 for directors then-serving when the guidelines were updated in May 2019. For purposes of this ownership and holding requirement, (a) shares owned outright or in trust and (b) restricted stock, including shares that have been granted but are unvested, are included. In addition, each non-employee director is required to hold all of their shares until the guidelines are met, except for sales of shares to pay taxes with respect to the vesting or exercising of equity grants. Other than Mr. Parisi, and Ms. Sommers, Ms. McPeek, and Messrs. Fong and Matturri, who were first elected to our Board in 2018, 2019 and, with respect to the last three, 2020, respectively, each of the non-employee incumbent directors has met the ownership requirement as of December 31, 2018. | Cboe Global Markets 2019 Proxy Statement

| 23

|

Director Hedging and Pledging Policies Under our Insider Trading Policy, our directors are prohibited from entering into transactions involving options to purchase or sell our common stock or other derivatives related to our common stock. Our Insider Trading Policy also prohibits directors from entering into any pledges or margin loans on shares of our common stock. None of the directors have existing hedges, pledges or margin loans on shares of our common stock. 2432

| Cboe Global Markets 20192021 Proxy Statement | |

executive Compensation PROPOSAL 2 - ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION In accordance with Section 14A of the Exchange Act, the Board is providing our stockholders with an advisory vote to approve executive compensation. This advisory vote, commonly known as a “say-on-pay” vote, is a non-binding vote to approve the compensation paid to our named executive officers as disclosed in this proxy statement in accordance with SEC rules. The Board has adopted a policy of providing for annual “say-on-pay” votes in accordance with the results of our last stockholder advisory vote. As discussed in the “Compensation Discussion and Analysis” section, our executive compensation program is designed to meet the following objectives:   attract and retain talented and dedicated executives, attract and retain talented and dedicated executives,

motivate our executives to achieve corporate goals that create value for our stockholders, and motivate our executives to achieve corporate goals that create value for our stockholders, and

align the compensation of our executive officers with stockholder returns. align the compensation of our executive officers with stockholder returns.

The Compensation Committee has implemented the following best practices applicable to our executive officers in order to achieve these objectives:   a high proportion of total compensation is in the form of performance-based compensation with limits on all incentive award payouts, a high proportion of total compensation is in the form of performance-based compensation with limits on all incentive award payouts,

incentive awards include financial measures and a relative stock price performance goal, incentive awards include financial measures and a relative stock price performance goal,

double trigger change in control provisions in equity awards and for severance benefits in employment agreements and the Executive Severance Plan, double trigger change in control provisions in equity awards and for severance benefits in employment agreements and the Executive Severance Plan,

prohibition on hedging, prohibition on hedging,

prohibition prohibition ofon pledging,

elimination of tax gross-up payments in the event of a change in control, and elimination of tax gross-up payments in the event of a change in control, and

clawbacks of incentive compensation. clawbacks of incentive compensation.

We believe that the compensation paid to the named executive officers is appropriate to align their interests with those of our stockholders to generate stockholder returns. Accordingly, the Board recommends that our stockholders vote in favor of the say-on-pay vote as set forth in the following non-binding resolution: RESOLVED, that our stockholders approve, on an advisory basis, the compensation paid to our named executive officers, as disclosed in this Proxy Statement, including under the heading “Compensation Discussion and Analysis,” the accompanying compensation tables and the corresponding narrative discussion. As this is an advisory vote, the outcome of the vote is not binding on us with respect to executive compensation decisions, including those relating to our named executive officers. Our Compensation Committee and Board value the opinions of our stockholders. The Compensation Committee and Board will consider the results of the say-on-pay vote and evaluate whether any actions should be taken in the future. | Cboe Global Markets 20192021 Proxy Statement | 2533

|

Non-binding approval of our executive compensation program requires that a majority of the shares cast on this matter be cast in favor of the proposal. Abstentions and broker non-votes will not be counted as votes cast and therefore will not affect the vote. The Board recommends that the stockholders vote FOR approval, in a non-binding resolution, of the compensation paid to our executive officers. COMPENSATION DISCUSSION AND ANALYSIS This Compensation Discussion and Analysis section is intended to provide our stockholders with an understanding of our compensation practices and philosophy, material elements of our executive compensation program, and the decisions made in 20182020 with respect to the total compensation awarded to, earned by, or paid to each of the following 20182020 “named executive officers” or “NEOs”: Name | Title* | Edward T. Tilly | Chairman, President and Chief Executive Officer (1) | Christopher R. ConcannonA. Isaacson | Executive Vice President and Chief Operating Officer (2) | Brian N. Schell | Executive Vice President, Chief Financial Officer and Treasurer | Christopher A. Isaacson

| Executive Vice President, Chief Information Officer (3)

| Mark S. HemsleyDavid Howson

| Executive Vice President, President Europe | Joanne Moffic-SilverBryan Harkins

| Former Executive Vice President, General Counsel and Corporate Secretary (4)Head of Markets Division

|

* | Titles are as of December 31, 2020. |

*Titles are as of December 31, 2018.

34 | (1)

| | Mr. Tilly was also appointed our President effective January 14, 2019.

|

| (2)

| | Mr. Concannon’s last day with the Company was January 14, 2019.

|

| (3)

| | Mr. Isaacson was appointed Executive Vice President and Chief Operating Officer effective January 14, 2019.

|

| (4)

| | Ms. Moffic-Silver’s last day with the Company was February 28, 2018.

|

26

| Cboe Global Markets 20192021 Proxy Statement | |

This Compensation Discussion and Analysis section is organized as follows: Executive Summary

The design of our executive compensation program, including compensation practices and independent oversight, is intended to align management’s interests with those of our stockholders and pay for our performance. Compensation awarded in 2018 reflects another year of record results and our continued successful integration with Bats.

| Cboe Global Markets 20192021 Proxy Statement | 2735

|

Executive Summary Principal Components of 2020 Executive Compensation | |

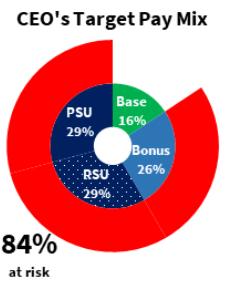

| Base Salary (16% of CEO’s target pay mix) | |  Fixed level of cash compensation based on performance, expertise, experience, and market value Fixed level of cash compensation based on performance, expertise, experience, and market value

| |  Target annual incentive is based on percentage of base salary Target annual incentive is based on percentage of base salary

| | Annual Incentive Bonus (26% of CEO’s target pay mix) | |  Provides variable cash compensation payout opportunities to the extent pre-established EBITDA and net revenue corporate and individual performance goals are met over one-year performance period Provides variable cash compensation payout opportunities to the extent pre-established EBITDA and net revenue corporate and individual performance goals are met over one-year performance period

| |  Individual performance goals include, among others, ESG related goals such as attracting, engaging, developing and retaining key talent, communicating with investors, promoting a culture of inclusion, succession planning, and overseeing a pipeline of diverse talent Individual performance goals include, among others, ESG related goals such as attracting, engaging, developing and retaining key talent, communicating with investors, promoting a culture of inclusion, succession planning, and overseeing a pipeline of diverse talent

| |  Payouts range 0% to 200% of executive’s target bonus opportunity Payouts range 0% to 200% of executive’s target bonus opportunity

| | Long-Term Equity Awards -Restricted Stock Units (29% of CEO’s target pay mix) |

|  Provides compensation in the form of Company shares to the extent three-year graded service period is met Provides compensation in the form of Company shares to the extent three-year graded service period is met

| |  Aligns interests of our executives with those of our stockholders and encourages retention Aligns interests of our executives with those of our stockholders and encourages retention

| | -Performance Share Units (29% of CEO’s target pay mix) | |  Provides variable compensation in the form of Company shares to the extent pre-established relative total stockholder return (“TSR”) and earnings per share (“EPS”) goals are met over a 3-year period Provides variable compensation in the form of Company shares to the extent pre-established relative total stockholder return (“TSR”) and earnings per share (“EPS”) goals are met over a 3-year period

| |  Aligns the interests of our executives with stockholders, provides significant incentive for retention, and motivates our executives to focus on our long-term growth and increased stockholder value Aligns the interests of our executives with stockholders, provides significant incentive for retention, and motivates our executives to focus on our long-term growth and increased stockholder value

| |  Payouts range 0% to 200% of executive’s target number of PSUs Payouts range 0% to 200% of executive’s target number of PSUs

|

Performance Affecting Fiscal 2020 Annual Incentive Pay Outcomes | | | 2020 Adjusted Net Revenues1 | | 2020 Adjusted EBITDA1 | $1,213 Million | | $865 Million |

| |

| 96% of Target Earned | | 124% of Target Earned |

Performance Affecting 2018-2020 PSU Pay Outcomes | | | 3-Year Adjusted EPS1 | | 3-Year Relative TSR | $15.02 | | 14th Percentile |

| |

| 200% of Target PSUs Earned | | 0% of Target PSUs Earned |

1 Adjusted revenues less cost of revenues (“net revenues”), adjusted earnings before interest, taxes, depreciation, and amortization (“adjusted EBITDA”), and 3-year adjusted EPS are non-GAAP measures used by the Company and reconciliations to GAAP measures are provided in Appendix A. 36 | Cboe Global Markets 2021 Proxy Statement | |

Compensation Governance Practices What we do |

| What we don’t do |   Mitigate compensation risk Mitigate compensation risk

Enforce robust mandatory stock ownership and holding guidelines Enforce robust mandatory stock ownership and holding guidelines

Utilize independent compensation consultant Utilize independent compensation consultant

Maintain a Compensation Committee that is composed solely of independent directors Maintain a Compensation Committee that is composed solely of independent directors

Active engagement with stockholders Active engagement with stockholders

Maintain double trigger change in control provisions in equity Maintain double trigger change in control provisions in equity award agreements (beginning with the 2019 equity award agreements)awards and for severance benefits in employment agreements offer letter agreements and the Executive Severance Plan

Provide clawback provisions for cash incentive and equity incentive awards for executives Provide clawback provisions for cash incentive and equity incentive awards for executives

Impose maximum caps and limits on short- and long-term incentive award payouts Impose maximum caps and limits on short- and long-term incentive award payouts

| | Ä No hedging orof Company stock by executives

Ä No pledging of Company stock by executives Ä No tax gross-ups upon a change in control or otherwise

Ä No excessive use of employment contracts

Ä No payouts for below threshold level for corporate performance

Ä No excessive perquisites

Ä No guaranteed annual incentive payments

|

2018 Compensation Program Overview

2020 Business Highlights Cboe Global Markets and its Board are committed to a corporate mission and strategy designed to create long-term stockholder value. Our strategy to lead the industry in defining the markets of today and tomorrow is to: | (1) | build upon core proprietary products, |

| (2) | leverage leading proprietary trading technology, |

| (3) | diversify business mix with growth of non-transactional revenue, |

| (4) | broaden geographic reach, and |

| (5) | expand product lines across asset classes. |

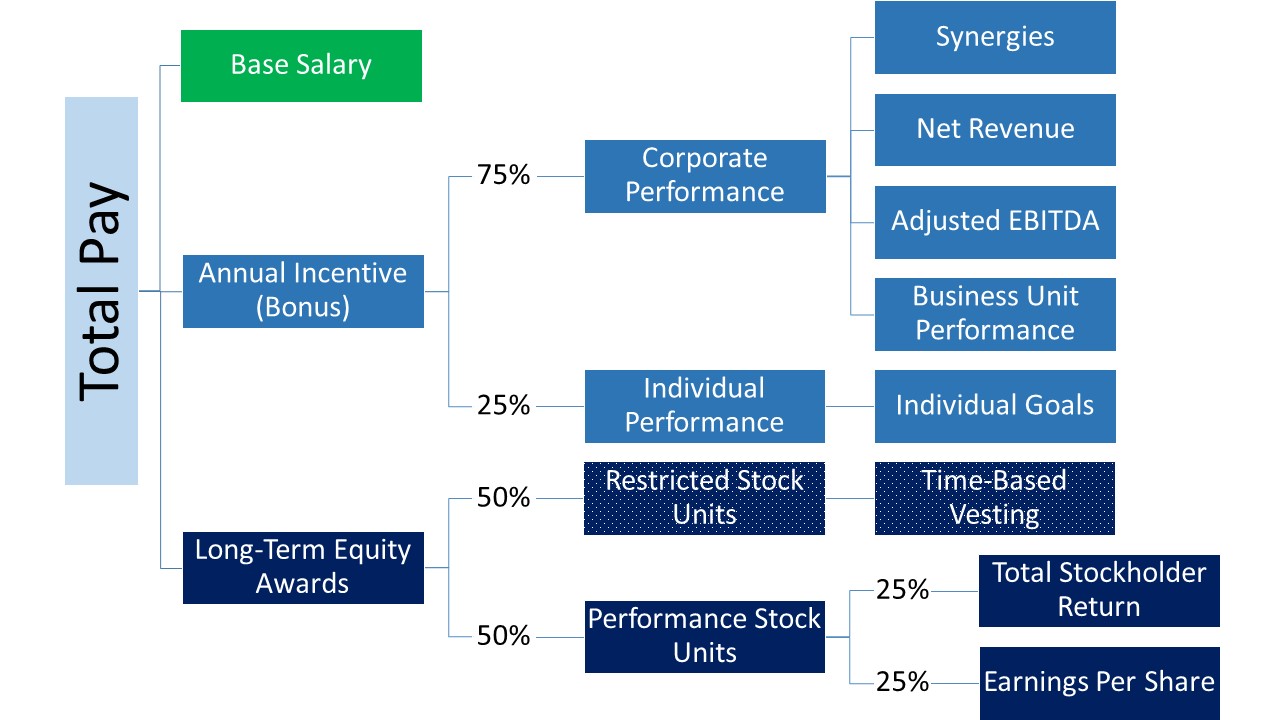

The following is a brief summary of our 2018 executive compensation program.  Market-competitive base salary.

High proportion of named executive officers’ total compensation was composed of performance-based compensation.

Annual cash incentive for 2018 was based on corporate performance (weighted 75%) measured against pre-established adjusted EBITDA, net revenue and synergies goals and individual performance (weighted 25%) measured against pre-established individual strategic goals.

Long-term incentive for 2018 was comprised of 50% time-based restricted stock units (“RSUs”) and 50% performance-based restricted stock units (“PSUs”), with performance contingent on achievement of relative total shareholder return and earnings per share goals

Market competitive retirement, medical, life and disability arrangements that are generally available to all employees.

28

| Cboe Global Markets 2019 Proxy Statement

| |

2018 Business Highlights

The following is a brief summary of our 20182020 business highlights as they relate to the ongoing commitment of our team and the Board to this strategy and the key performance metrics used in our performance-based compensation program as well as other business highlights.program.

Financial Results Financial Results

| o | | Achieved record 2018 full year financial results.

|

| o

| | Net revenues of $1,217$1,254 million for 2018,2020, up 22%10% from $996$1,137 million for 2017, and up 14% from net revenues on a combined company basis of $1,068 million for 2017.1 2019. |

| o | | Diluted EPS of $3.76$4.27 for 2018,2020, up 2%28% from $3.69$3.34 for 2017, and adjusted diluted EPS of $5.02 for 2018, up 41% from adjusted diluted EPS on a combined company basis of $3.57 for 2017.1 2019. |

Business Results Business Results

| o | | Adjusted EBITDA of $840 million for 2018, up 18% from adjusted EBITDA on a combined company basis of $709 million for 2017.1

|

Bats Acquisition Integration Bats Acquisition Integration

| o

| | Exited 2018 with run rate expense synergies of $57 million, primarily seen in compensation and benefits and professional fees and outside services. We also continued to make solid progress executing on our integration plans.

|

| o

| | Increased our run-rate expense synergy target to $85 million, up by $20 million.

|

| o

| | On February 25, 2018 and May 14, 2018, we successfully completed the migrations of CFE and C2, respectively, to the Bats technology platform.

|

Business Segment Results Business Segment Results

| o

| | Set new annual average daily volume (“ADV”) highs for trading in options, index options, SPX options,Launched mini VIX futures and FX.

options on S&P 500 ESG Index. |

| o | Acquired and integrating information solutions companies Hanweck, FT Options, and Trade Alert, in furtherance of the Company’s strategy to increase non-transactional revenue. |

| o

| | ADV growth for 2018 across each business segment.

|

| | o

| | Created two new Cboe corporate bond index futures.

|

| o

| | Cboe Europe prospered in post MiFID II environment with growth in our Periodic Auctions book, a MiFID II- compliant lit order book, and increased volume in our Large-In-Scale block trading platform.

|

| o

| | Grew our global FX market share to approximately 15% for the year, up from approximately 13% in 2017.2

|

| 1

| | Net revenues on a combined company basis, adjusted diluted EPS and adjusted diluted EPS on a combined company basis, adjusted EBITDA and adjusted EBITDA on a combined company basis are non-GAAP measures used by the Company and reconciliations to GAAP measures are provided in Appendix A.

|

| 2

| | Market Share represents Cboe FX volume divided by the total volume of publicly reporting spot FX venues (Cboe FX, EBS, Refinitiv, and FastMatch).

|

| Cboe Global Markets 20192021 Proxy Statement | 29

37 |

| o | Acquired MATCHNow, BIDS Trading, and EuroCCP to expand geographic reach and diversify product capabilities. |

| o | Started process to develop pan-European derivatives for a planned launch in 2021. |

Navigating COVID-19 Global Pandemic Navigating COVID-19 Global Pandemic

| o | Capitalized on increased engagement among retail investors, such that total options volume and total U.S. equities volume reached new all-time highs in 2020. |

| o | Successfully transitioned open outcry trading to all electronic trading when open outcry trading was temporarily suspended; then reopened the trading floor with a modified layout and stringent safety protocols in place. |

| o | Provided frequent communications to directors, employees, customers, regulators, critical vendors, technology equipment suppliers, data and disaster recovery centers, and other service providers. |

| o | Continued to operate our business and achieved solid results in 2020, while successfully shifting all global employees (except those deemed essential) to work from home on a temporary basis and implementing travel restrictions. |

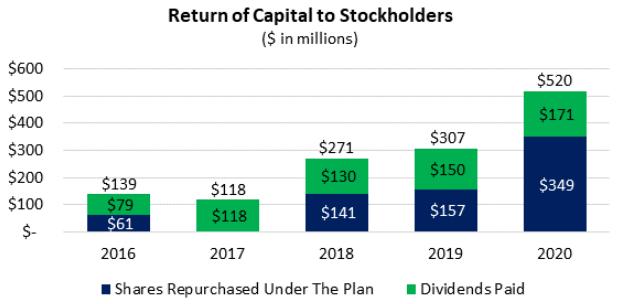

We believe that the performance of the Company demonstrates that management is keenly focused on driving the Company for sustainable long-term growth and diversifying the Company’s business, while obtaining short-term results. Our business continued to generate strong cash flows from operations and we paid down debt, repurchased our stockwere able to return $520 million to stockholders through dividends and deployed capital to enhance stockholder returnsshare repurchases while retaining the flexibility to pursue new growth opportunities. To that end, in 2018: 2020:   in keeping with our goal of consistent and sustainable dividend growth, we increased our quarterly dividend by in keeping with our goal of consistent and sustainable dividend growth, we increased our quarterly dividend by 15%17% to $0.31$0.42 per share and paid cash dividends of $130$171 million in 2018; 2020; and

we paid down $25 million of outstanding debt; and

1.33.5 million of our outstanding shares of common stock under a share repurchase program for a total of $141$349 million.

As a result ofDespite these business highlights andsolid results in 2020, capital allocation decisions, and successfully navigating the COVID-19 global pandemic, as of December 31, 2018,2020, we achieved a total stockholder return,returns, including reinvested dividends, of approximately 56%approximately:

-21% over the past year; -21% over the past year;

-22% over the past three -22% over the past three years and approximately 101%years;

53% over the past five 53% over the past five years. Despite record results in 2018, as of December 31, 2018, we achieved a total stockholder return, including reinvested dividends, of approximately -21% for 2018. years; and

387% over the past ten years. 387% over the past ten years.

Executive Compensation Program Practices Compensation Philosophy and Summary Our executive compensation program is designed to attract and retain talented and dedicated executives who are instrumental in our achievement of key strategic business objectives. To meet these objectives, the Compensation Committee designed and implemented a program that pays a substantial portion of executive compensation based on corporate and individual performance. The Compensation Committee believes that our executive compensation program plays a vital role in contributing to the achievement of key strategic business objectives that ultimately drive long-term business success. Accordingly, we designed our executive compensation program to focus our 38 | Cboe Global Markets 2021 Proxy Statement | |

executives on achieving critical corporate financial and strategic goals, while taking steps to position the business for sustained growth in financial performance over time. 30

| Cboe Global Markets 2019 Proxy Statement

| |

Our executive compensation program generally consists of the following elements, in addition to retirement, health, and healthwelfare benefits:

The following table lists the various components included in total compensation for our executive officers and each element’s purpose. Later sections provide additional details regarding each component.

| Total Compensation ComponentCboe Global Markets 2021 Proxy Statement

| | Purpose

| Base salary

| | Provides a fixed amount of compensation based on the market value of the position

| Annual incentive (bonus)

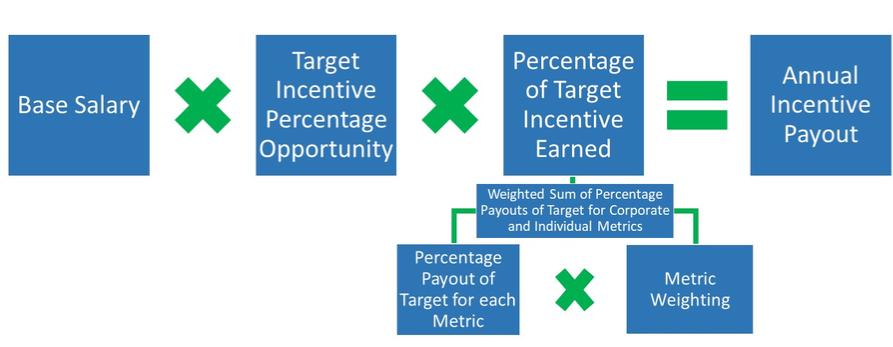

| | Provides variable cash compensation payout opportunities designed to reward each executive for the achievement of certain annual corporate and individual performance metrics measured against pre-established performance goals

| Long-term equity awards

| | Provide variable compensation in the form of equity, aligning the interests of our executives with stockholders and motivating our executives to focus on our long-term growth and increased stockholder value

| Benefits (retirement, medical, life and disability)

| | Provide competitive health, welfare and retirement benefits39

|

The following charts show the approximate 20182020 total target compensation mix for the Chief Executive Officer and the other named executive officers as a group (excluding Ms. Moffic-Silver).group. For the Chief Executive Officer and the other named executive officers, the majority of 20182020 total target compensation is “at-risk” (i.e., linked to achievement of performance goals and/or the value is tied to our common stock price) and, further, the majority of “at-risk” pay is in the form of equity | Cboe Global Markets 2019 Proxy Statement

| 31

|

awards. Total target compensation is the sum of an executive officer’s 20182020 base salary, target annual incentive opportunity and target value for long-term equity awards (i.e., RSUs and PSUs). Company’s Response to Stockholder Vote on Say‑on‑PaySay-on-Pay At the 20182020 Annual Meeting of Stockholders, our “say-on-pay” proposal received the support of over 94%93% of the votes cast for approval of our 20172019 executive compensation program as disclosed in our 20182020 Proxy Statement, and every year since going public in 2010, we have received over 85% stockholder support of our executive compensation programs. The Compensation Committee has reviewed the results of the stockholder vote on our 20172019 executive compensation program and considered such results supportive of our executive compensation program and the Compensation Committee’s measured approach to modifying our compensation practices to enhance their alignment with stockholder interests. In addition, the Compensation Committee has determined that the vote result did not warrant any large-scale changes to our executive compensation program; however, the Compensation Committee continues to take steps, as described below, to help ensure our compensation practices remain aligned with best practices and stockholder interests. Compensation Refinements The Board and Compensation Committee did not make any in-cycle changes to the annual incentive program or long-term equity awards in 2020 as a result of the COVID-19 global pandemic. 40 | Cboe Global Markets 2021 Proxy Statement | |

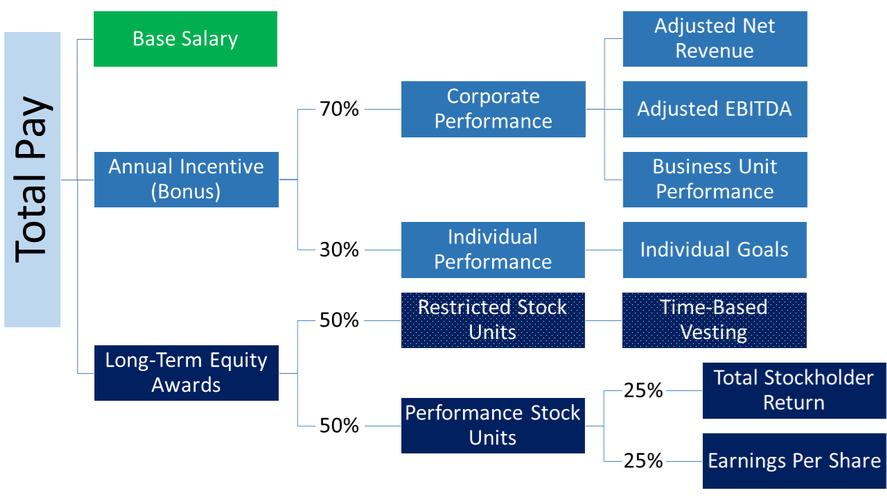

The Board and Compensation Committee determine actual annual incentive bonus payouts based on achieved results measured against pre-established corporate and individual performance goals. As a result of our executives’ continued focus on thesuccessful integration of Bats and a larger focus on growing our revenues and earnings,individual performance, at the beginning of 2020 the Compensation Committee changedremoved the annual incentive award’s corporate performance synergy metric and redistributed its weighting to individual and other corporate performance metrics in 2018 to better align the interests of our executives with our business strategy and with stockholders. For 2018,2020, the metrics and weightings were updated as follows: | | | 2019 Metrics | | 20182020 Metrics

|   Individual Performance (weighted 25%) Individual Performance (weighted 25%)

| |  Individual Performance (weighted 30%) Individual Performance (weighted 30%)

| |  Individual Performance (weighted 25%) Individual Performance (weighted 25%)

|   Corporate Performance (weighted 75%) Corporate Performance (weighted 75%)

| |  Corporate Performance (weighted 70%) Corporate Performance (weighted 70%)

| |  Corporate Performance (weighted 75%) Corporate Performance (weighted 75%)

| | | | oAchievement of SynergiesAdjusted Net Revenue

| Achievement of Net Revenue | | | oAchievement of Net Revenue

| | | oAchievement of Adjusted EBITDA

| Achievement of Adjusted EBITDA | | | oAchievement of Business Unit Performance

| Achievement of Business Unit Performance | | |

Historically, the Compensation Committee approved granting PSUs that were one-half subject to relative total stockholder return goals and one-half subject to earnings per share goals. As a result of

32

| Cboe Global Markets 2019 Proxy Statement

| |

the Bats acquisition, the Compensation Committee determined not to grant PSUs subject to earnings per share goals in 2017, due to the difficulty in setting a meaningful long-term earnings per share goal immediately following the acquisition. Therefore, in 2017 the Compensation Committee approved granting all PSUs subject solely to the achievement of relative total stockholder return.

However, due to the continued successful integration of Bats and a better ability to set a meaningful long-term earnings per share goal, in 2018 the Compensation Committee approved granting PSUs (i) one-half subject to the achievement of relative total stockholder return measured against pre-determined performance goals over a three-year performance period and (ii) one-half subject to the achievement of earnings per share measured against pre-determined performance goals over a three-year performance period.

Following the 2018 compensation decisions, the Compensation Committee reviewed our two peer groups, the Securities Exchange Peer Group and the Broader Financial and Technology Industry Peer Group, and approved combining them into a single 25 company peer group that adds new companies and removes certain companies from each of those existing two peer groups. The Committee made this determination because, following the acquisition of Bats and our recent growth, the Company’s revenue, gross profit, market capitalization and number of employees grew to be more in-line with our larger securities exchange peers.

Further, in connection with the grants of equity awards in 2019, the award agreements provide that in the event of a Change in Control (as defined in the Second Amended and Restated Long-Term Incentive Plan (the “Plan”)), each award will be "double trigger" unless a successor entity cannot or will not provide a "replacement award" (as defined in the Plan). If a successor entity cannot or will not provide a replacement award, the award will accelerate and be deemed fully vested and exercisable and all vesting conditions on restricted stock units will lapse, with all performance conditions deemed satisfied at the greater of target or the level of performance actually achieved as of the Change in Control (with similar performance assumed to be achieved through the remainder of the performance period). If the successor entity, including the Company if it is the surviving entity, assumes, continues or replaces an outstanding award (each such assumed, continued or replacement award, a replacement award), then such replacement award shall remain outstanding and be governed by its respective terms. Upon termination of the Participant's employment for any reason other than cause or by Participant with good reason upon or within two years after a Change in Control, such replacement award will accelerate and become fully vested and/or exercisable, with all performance conditions deemed satisfied at the greater of target or the level of performance actually achieved as of the employment termination date (with similar performance assumed to be achieved through the remainder of the performance period).

20182020 Target Annual Pay Opportunities

The following chart shows the 20182020 total target compensation for each named executive officer. | | | | | | | | Target Long-Term | | | | | | | | | | Target Annual | | Equity Awards | | | | | | | | | | | | | | Target Long-Term | | | | | | | | | | Target Annual | | Equity Awards | | | | Named Executive Officer(1) | | Base Salary | | Incentive Bonus | | RSUs (2) | | PSUs (2) | | Total | | Base Salary | | Incentive Bonus | | RSUs (2) | | PSUs (2) | | Total | Edward T. Tilly | | $ | 1,265 | | $ | 2,087 | | $ | 1,650 | | $ | 1,650 | | $ | 6,652 | | $ | 1,265 | | $ | 2,087 | | $ | 2,350 | | $ | 2,350 | | $ | 8,052 | Christopher R. Concannon | | $ | 1,100 | | $ | 1,650 | | $ | 1,100 | | $ | 1,100 | | $ | 4,950 | | Christopher A. Isaacson | | | $ | 650 | | $ | 975 | | $ | 875 | | $ | 875 | | $ | 3,375 | Brian N. Schell | | $ | 521 | | $ | 729 | | $ | 359 | | $ | 359 | | $ | 1,968 | | $ | 525 | | $ | 735 | | $ | 750 | | $ | 750 | | $ | 2,760 | Christopher A. Isaacson | | $ | 540 | | $ | 810 | | $ | 325 | | $ | 325 | | $ | 2,000 | | Mark S. Hemsley (3) | | $ | 619 | | $ | 681 | | $ | 300 | | $ | 300 | | $ | 1,900 | | Joanne Moffic-Silver | | $ | 433 | | $ | 606 | | $ | 288 | | $ | 288 | | $ | 1,615 | | David Howson (3) | | | $ | 575 | | $ | 633 | | $ | 325 | | $ | 325 | | $ | 1,858 | Bryan Harkins | | | $ | 500 | | $ | 500 | | $ | 325 | | $ | 325 | | $ | 1,650 |

| (1) | (1)

| | All amounts are in thousands. |

| (2) | (2)

| | Represents the grant date value. target equity award value used to calculate the number of shares to grant. |

| (3) | Cboe Global Markets 2019 Proxy Statement

| 33

|

| (3)

| | Mr. HemsleyHowson receives his cash compensation in British pounds. The amounts reported were converted to U.S. dollars using a rate of £1.00 to $1.28,$1.37, which was the exchange rate as of December 31, 2018. 2020. |

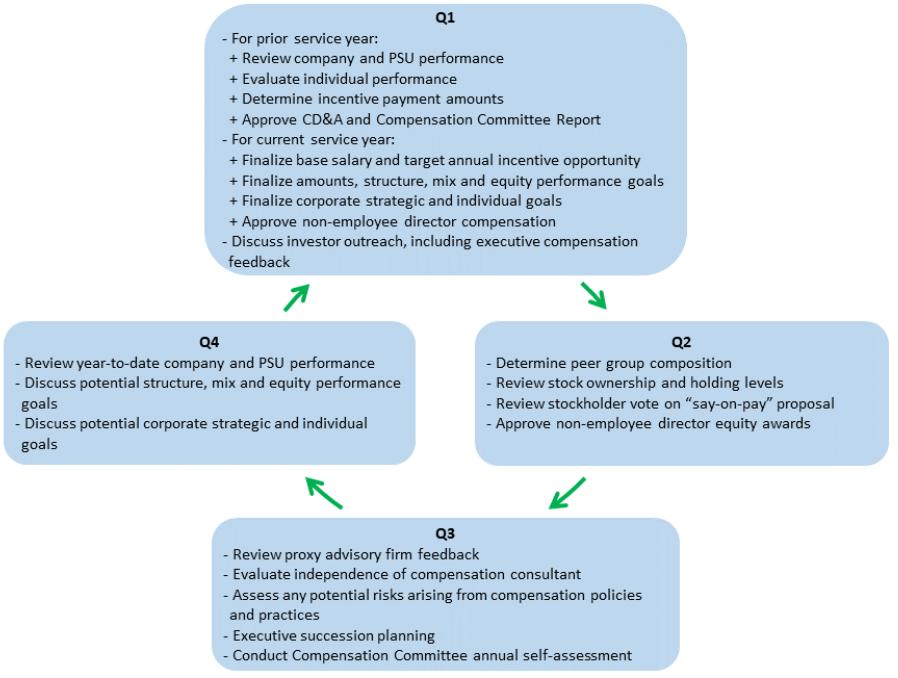

This supplemental table is not required, but rather it is provided to demonstrate the link between performance and our named executive officers’ total directtarget compensation opportunity for 2018.2020. Please refer to the Summary Compensation Table below for complete disclosure of the total compensation of our named executive officers reported in accordance with the SEC disclosure requirements. Role ofExecutive Compensation Program Governance Cycle

Throughout the year, the Board and the Compensation Committee are heavily involved in reviewing, monitoring, and approving, as applicable, the executive compensation program. The Compensation Committee, composed of all independent directors, is responsible for reviewing the various components of the total compensation program for all executive officers. The Compensation Committee met 67 times in 2018.2020. The Compensation Committee either approves or makes recommendations to the Board regarding compensation related decisions. To provide the Compensation Committee with advice and assistance related to the design of our executive compensation program, the Compensation Committee engaged Meridian Compensation Partners, LLC (“Meridian”) as its independent compensation consultant. As described below in further detail, Meridian consultants regularly attend meetings of the Compensation Committee. In addition, Messrs. Tilly, ConcannonIsaacson, and Schell generally attended in 2018 portions of the 2020 meetings of the Compensation Committee to provide information and assistance, other than when the Compensation Committee discussed the respective executive’s compensation. | Cboe Global Markets 2021 Proxy Statement | 41 |

While specific topics may vary from meeting to meeting, the following illustration describes the general annual cycle of the Board’s and Compensation Committee’s activities.

Independent Compensation Consultant For 2020, the Compensation Committee engaged Meridian ouras its independent compensation consultant to provide the Compensation Committee with advice and assistance related to the design of our executive compensation program. Meridian reviews our executive compensation program and advises the Compensation Committee on best practices and plan design to help improve the Company’s program’s effectiveness.effectiveness and alignment with market practices. In addition, the consultantMeridian provides advice to the Compensation Committee on the Company’s compensation peer groupsgroup and on the competitive positioning of the various components of the executive compensation program. The independent compensation consultantMeridian consultants regularly attend meetings of the Compensation Committee. Meridian also meets with the Compensation Committee in executive session without management present and may communicate directly, as needed, with members of the Compensation Committee and the Board at large. Based on a review of its engagement of the independent compensation consultantMeridian and consideration of factors set forth in SEC Nasdaq and BZX rules, the Compensation Committee determined that Meridian’s work did not raise any conflicts of interest and that it is independent from management. 42 | Cboe Global Markets 2021 Proxy Statement | |

Tally Sheets When reviewing compensation for the named executive officers, the Compensation Committee considersmay consider tally sheets that detail the various elements of compensation for each executive. These tally sheets, developed with the assistance of Meridian, are used to evaluate the appropriateness of theeach named executive officer’s total compensation package, to compare each executive’s total compensation opportunity with his or her actual payout, to assess the level of holding power in unvested equity awards, and to help ensure that the compensation appropriately reflects the executive compensation program’s focus on pay for performance and alignment with stockholder interests. Peer GroupsGroup and Comparative Data For the 20182020 compensation decisions, the Compensation Committee used twoa single peer groupsgroup from which to derive competitive market compensation data: (i) the Securities Exchange Peer Group and (ii) the Broader Financial and Technology Industry Peer Group.data. The Securities Exchange Peer Group24-company peer group was composed of sevenexchange holding companies, each with a heavy focus on our industry. The Broader Financial and Technology Industry Peer Group was composed of 20 companies, and included financial services firms, and technology-focused companies with corporate profiles similar to ours, with revenues ranging between one-third and three-timesours. Based on the then-available fiscal year 2019 data, the Company’s projected annual revenue. The 34

| Cboe Global Markets 2019 Proxy Statement

| |

Compensation Committee utilized this twoemployees fell below the median of the peer group model to derive meaningful compensation data due to our unique business model and to ensure that each named executive officer’s target total compensation is competitive.group. The Compensation Committee used thisthe market data derived from the peer group as points of reference, rather than as the sole determining factor in setting compensation for our named executive officers.

Securities Exchange Peer Group

| | ASX Limited

| Intercontinental Exchange, Inc.

| CME Group Inc.

| Nasdaq, Inc.

| Deutsche Borse AG

| TMX Group Limited

| London Stock Exchange Group plc

| |

Broader Financial and Technology Industry Peer Group

| Akamai Technologies, Inc.

| MarketAxess Holdings Inc.

| BGC Partners, Inc.

| MSCI Inc.

| The Dun & Bradstreet Corporation

| Piper Jaffray Companies

| E*TRADE Financial Corporation

| SEI Investments Company

| Euronet Worldwide, Inc.

| SS&C Technologies Holdings, Inc.

| FactSet Research Systems Inc.

| TransUnion

| Fair Isaac Corporation

| Tyler Technologies, Inc.

| GAIN Capital Holdings, Inc.

| The Ultimate Software Group, Inc.

| Jack Henry & Associates, Inc.

| Verint Systems Inc.

| Manhattan Associates, Inc.

| WEX Inc.

|

Following the 2018 compensation decisions, the Compensation Committee reviewed the two peer groups. The Committee reviewed the data provided by Meridian and compared our corporate performance to our peer groups in the areas of revenues, gross profit, market capitalization and number of employees. The Committee also considered business descriptions, complexity of business, company locations and other qualitative factors. Following the acquisition of Bats and our recent growth, the Company’s revenue, gross profit, market capitalization and number of employees grew, and now fall closer to the median revenue, gross profit, market capitalization and number of employees of the industry-specific Securities Exchange Peer Group. As a result, the Committee approved combining the two groups into a single peer group that adds new companies and removes certain companies of the existing Securities Exchange Peer Group and the Broader Financial and Technology Industry Peer Group. With respect to the updated single peer group, the Company’s annual revenue falls slightly below the median of the peer group, gross profit falls below the median of the peer group, market capitalization falls at the median of the peer group and number of

| Cboe Global Markets 2019 Proxy Statement

| 35

|

employees falls below the median of the peer group. The following is the updated 25 company single peer group:

Updated Single Peer Group

| Akamai Technologies, Inc. | London Stock Exchange Group plc | Broadridge Financial Solutions, Inc. | LPL Financial Holdings Inc. | Citrix Systems, Inc. | MarketAxess Holdings Inc. | CME Group Inc. | MSCI Inc. | Deutsche Borse AG | Nasdaq, Inc. | The Dun & Bradstreet CorporationEquifax Inc.

| SEI Investments Company | Equifax Inc.E*TRADE Financial Corporation

| SS&C Technologies Holdings, Inc. | E*TRADE Financial CorporationEuronet Worldwide, Inc.

| Stifel Financial Corp. | Euronet Worldwide, Inc.

| Synopsys, Inc.

| FactSet Research Systems Inc. | TransUnionSynopsys, Inc.

| Fortinet, Inc. | Verisk Analytics, Inc.TransUnion

| Intercontinental Exchange, Inc. | Virtu Financial,Verisk Analytics, Inc.

| Jack Henry & Associates, Inc. | |

The following companies were added and removed from the existing Securities Exchange Peer Group and the Broader Financial and Technology Industry Peer Group:

Added

| | Removed

| Broadridge Financial Solutions, Inc.

| | ASX Limited

| Citrix Systems, Inc.

| | BGC Partners, Inc.

| Equifax Inc.

| | Fair Isaac Corporation

| Fortinet, Inc.

| | GAIN Capital Holdings, Inc.

| LPL Financial Holdings Inc.

| | Manhattan Associates, Inc.

| Stifel Financial Corp.

| | Piper Jaffray Companies

| Synopsys, Inc.

| | TMX Group Limited

| Verisk Analytics, Inc.

| | Tyler Technologies, Inc.

| Virtu Financial, Inc. |